Record-breaking global bond rally collapses as new inflation fears grip investors

The record global bond market rally since early this year has stalled as signs of sustained inflation have forced investors to reverse their views on the possibility of future interest rate hikes. .

In the first few weeks of 2023, investors rushed into bonds as expectations grew that the US Federal Reserve (Fed) and other major central banks would soon end their aggressive monetary policy tightening campaign. .

The Bloomberg Index shows high levels of government and corporate bonds Last month it rose 4%, making it the best start to the year.

But that gain vanished when the US Labor Market Report earlier this month released better-than-expected economic data on both sides of the Atlantic. federal reserve system The European Central Bank was trying to win the fight against inflation.

The resulting rise in bond yields has also disrupted the stock market rally, with the S&P 500 down 2.7% last week.

“It’s a reality check,” said Michael Metcalf, head of macro strategy at State Street, adding that the easing of monetary policy that the market expected a few weeks ago was “a bit fantastical.”

The biggest reversal happened in the US Add over 500,000 jobs In January, nearly triple economists’ forecasts, consumer prices rose 6.4%, also better than expected.

The Fed’s Favorite Inflation Indicator on Friday — Core Monthly Personal Consumption Expenditure — 0.6% increase Beating consensus expectations in December and January.

The futures market reflected earlier bets that the US central bank would cut interest rates twice this year, but now rates have risen to 5.4% by July, with at most one rate cut by the end of the year. is expected to take place.

“Earlier this year, the market was ahead of the curve on pricing the Fed rate cuts in hopes of ending the cycle sooner,” said Idanna Appio, portfolio manager at First Eagle Investment Management.

“Investors were betting that the Fed would successfully and quickly bring inflation down.

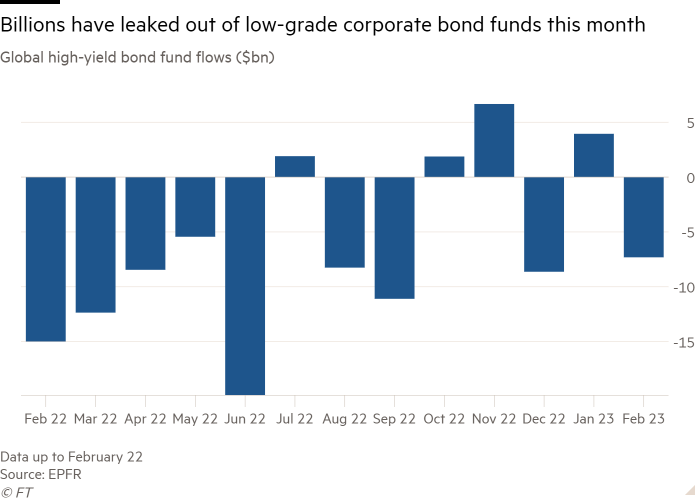

Further reflecting the shift in sentiment, fixed income capital flows have reversed in recent weeks, especially on the riskier side of the credit spectrum.

After a surge in January, emerging market bonds saw their biggest outflow since October this week, according to JPMorgan data. After net inflows of $3.9 billion in January, he has seen more than $7 billion of his outflow from ‘junk’ rated corporate bond funds globally so far in February, according to EPFR data. increase.

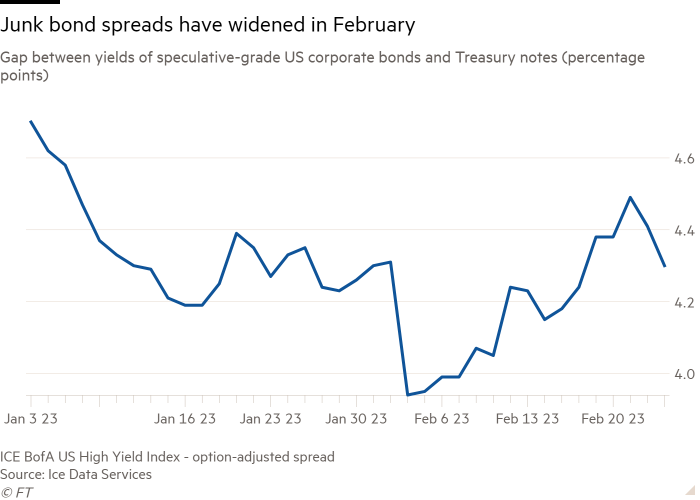

Investors are demanding a higher premium than last month to hold high-yielding, low-rated corporate bonds.

The spread between US junk bond yields and Treasury yields has narrowed by 0.87 points since New Year’s Eve, reaching 3.94 points in mid-January. But that spread has since widened to his 4.3 points.

John McClain, portfolio manager at Brandywine Global Investment Management, said rates are likely to remain higher than expected “for the foreseeable future.”

“We do not expect a rate cut in 2023, which will ultimately put stress on the riskier credit sector,” he said.

The shift in investor expectations is an acknowledgment that the Fed has been insisting since the beginning of the year that it will continue to raise rates for an extended period of time. A survey of Fed officials from December showed they expected borrowing costs to be around 5.1% by the end of the year.

Some analysts now wonder if central banks’ own forecasts are too conservative.

“It could well be over 6%,” said Calvin Tse, head of macro strategy for the Americas at BNP Paribas. Interest rates will likely have to go up,” he said.

Some big investors say the recent plunge shows it’s too early to pile on bonds. That moment is likely to come later this year.

“Of course the Fed would cut rates eventually, but the market was trying to get ahead of it . I think it’s a very good year for fixed income.I don’t think we’re there yet.”

https://www.ft.com/content/b287997b-a048-426c-bab3-9a6a97486c17 Record-breaking global bond rally collapses as new inflation fears grip investors