Tesla stock did something important

Tesla stock is not for the faint of heart. Stocks can go up or down at any moment, depending on what the fickle CEO Elon Musk says and does.

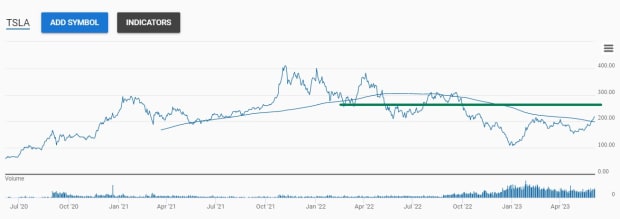

When Tesla stock soared, most people were happy to make the tradeoff. But last year’s disappointing results likely tested shareholders’ resolve. Those who remained stockholders took it easy in 2022, but Tesla stock has been rallying lately, and that rally is strong enough for the stock to do something for the first time in eight months. is showing

Tesla: Boom and Depression Stocks

Tesla shares have been one of the biggest beneficiaries of monetary easing introduced during the coronavirus pandemic. From its March 2000 low to its November 2021 high, Tesla stock surged a staggering 1,674%, creating legions of Elon Musk fans. However, not everyone was convinced. The rally in Tesla’s stock has pushed its valuation to astounding heights, prompting many to wonder if the rally in the stock is a bubble destined to burst.

Those skeptical will be rewarded in 2022. After its meteoric rally, Tesla stock fell 75% from its highs to January 2023 lows. The drop may have encouraged many who had bet on Elon Musk by shorting Tesla stock. But given that Tesla’s share price nearly doubled by mid-February, it hasn’t been good news for short sellers since.

These days, Tesla shares have settled in the $152 to $218 trading range, and have oscillated up and down in search of conviction.

Tesla stock returns to key levels

The sideways trading of Tesla shares suggests that bulls and bears are vying for control. With no clear direction, many investors will probably sit on the sidelines waiting to see who comes out on top.

Stocks closed past 200 days last week and may have taken a step towards declaring a winner moving average (DMA) First time since September in mass production.

every day trading volume It has been above average since last Wednesday, suggesting some investors may be on the sidelines. It could also suggest that the short-selling Tesla stock is being bought to cover positions to prevent further losses.according to nasdaq dataMore than 95 million Tesla shares were sold short in mid-May.

It wouldn’t be a coincidence that intraday volume growth and the stock rebounded to the 200-DMA.

Many consider the 200-DMA to be a key barometer of long-term sentiment and use it as a decision-making boundary. They buy when the stock trades above it and sell when the stock trades below.

Forget Tesla – we’re all in on this EV stock

What’s next for Tesla stock?

While the company’s stock price above the 200-DMA is bullish, it doesn’t mean the stock is completely out of the woods. Investors will be watching to see if the price closes above $218 as it is still trading in a flat range. A higher price target could then come into play.

I can discuss some resistance levels above, including a nice target around $250. in May, real money‘Bruce Camich, who has analyzed price charts for nearly 50 years, calculated a price target of $245 For Tesla, use the daily points and numbers chart. He said April’s close above $208 would Long-Term Point And Figure Chart Target Is $443 in the play.

Of course, that long-term goal is unlikely to be achieved any time soon. Stocks don’t go up and down in a straight line, so some digestion shouldn’t be surprising in the short term. If so, the 200-DMA test and hold could be a catalyst towards $240-$250 levels, so that’s what I’m looking for from here.

https://www.thestreet.com/electric-vehicles/teslas-stock-just-did-something-important Tesla stock did something important