Are growth stocks back?Kathy Wood’s ARKK trades at multi-month high

Growth stocks have rebounded recently, with many investors turning to Kathy Wood’s ARK Innovation ETF (Arkuk)- Get Free Reporton behalf of those shares.

But even for those who don’t, it’s hard to deny the recent strength of various stocks in the sector. Stocks like Shopify (shop)- Get Free ReportUber (uber)- Get Free ReportRoku (Roku)- Get Free ReportDigital Ocean (DOCN)- Get Free ReportSoFi (Sophie)- Get Free ReportSome are trading much better on the long term.

While pessimism persists in the world, growth stocks are starting to show more constructive price action.

Don’t Miss: How High Will SoFi Shares Go? Charts provide clues.

Recent ARKK ETFs Fulfilled the first close over 50 weeks moving average After September 2021.

That being said, just Rotation to small caps, I don’t know how long this strength will last. If the recent momentum doesn’t last, growth stocks could run out of steam quickly.

But if we see continued strength in the group, there could be plenty of upside potential given the pain these stocks suffered in 2015. bear market.

How far can ARKK reach?

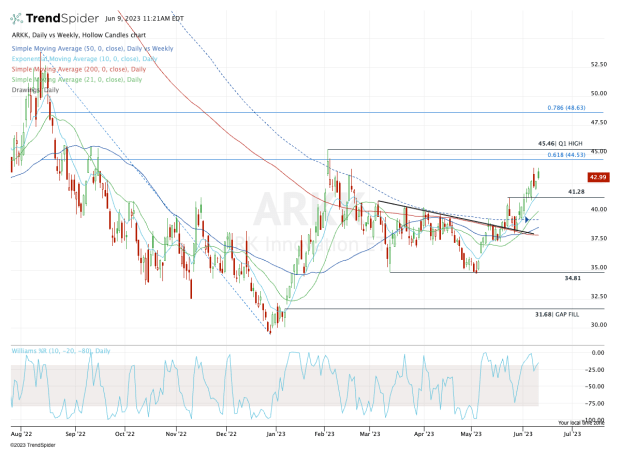

Chart courtesy of TrendSpider.com

On Friday, the shares of the ARKK ETF were pushing up to the week’s high of $43.83. But with a broad mix of markets, the highs are getting farther away.

From here, the bulls should watch the $43.83 area closely. A break above this level opens the door to a 61.8% retracement and Q1 highs near $44.50 and $45.50 respectively.

If the ARKK ETF really ignites and pushes further up this zone, the 78.6% retracement could move closer to $48.50 and then to $50.

On the flip side, this stock is doing very well. This should help buyers control the decline, at least initially.

Don’t Miss: CVS Health and Walgreens: Short or Long?

Now that ARKK has broken out of that level, notice how the $41 levels are holding firm as support. It helps that the 10-day moving average works around this level.

Once the breakdown is determined, $40, which marks the 21-day and 50-week moving averages, could be the focus of attention. From a technical point of view, failing this level is very unsound.

However, buyers will have another chance if the stock falls to the $38 territory. There they will find resistance above the 200-day moving average and the previous downtrend.

Receive investment guidance from a trusted portfolio manager with no management fees.Apply Action alert PLUS now.

https://www.thestreet.com/investing/stocks/growth-stocks-trading-cathie-woods-arkk-multimonth-highs-technical-analysis Are growth stocks back?Kathy Wood’s ARKK trades at multi-month high