Upstart: A bright spot in a bad report

Upstart missed Q3 2022 guidance.

Anirvan Mahanti

start-up UPST missed that guidance Comprehensive Q3 2022. After a quick look at the results, I was very disappointed. As I’ve said many times, companies should refrain from providing guidance if they miss it or have to revise it downward on a regular basis. After all, if Apple can solve problems with qualitative guidance alone, Upstart will be fine without it. Anyway, it’s a rant.

But when we dig into the results, we see good progress in weathering this macroeconomic headwind. David Girourad and his team continue to improve the current personal credit offering while also developing new types of credit. Product and partnership progress is real. And the company has the runway to deal with this downturn thanks to its $800 million cash balance.

I think the business is making the right decisions to be stronger on the other side.

Let’s dive into some of the details with these high-level comments.

let’s take Earnings Miss. Guidance was her $170 million, but earnings came to her $157 million. But if you look closely, fee income was her $179 million, with fair value adjustments and losses from selling loans. Balance sheet Upstart costs about $22 million. I am not saying that these adjustments are not a problem. Losses are real when loans held on the balance sheet are sold. However, losses on these loans are difficult to predict as they are a function of macroeconomic conditions and interest rate dynamics.

The number of loans processed by the Upstart platform is now much lower. In Q3 2022, Upstart processed 188,000 loans, down 48% year over year. With interest rates high, this dramatic cut is straightforward. His CEO and co-founder Girouard sums things up nicely in his opening remarks.

“Rising interest rates and significantly higher risks in the economy mean that we are approving about 40% fewer applicants than we were a year ago. are seeing offers that are about 800 basis points higher than they were a year ago.”

Lending partners are cautious in the current situation. Rising interest rates also significantly reduce the pool of viable borrowers. After all, interest rates that are 800 basis points higher than they were a year ago are no joke.

However, although the loan volume was cut in half, the company managed to significantly increase its contribution margin. Contribution margin was 54% for him, well below guidance for him at 59%, but 800 basis points higher than Q3 2021. Upstart has done so by increasing its fees per loan, reducing marketing expenses in certain channels, and tweaking other operating expenses. Operating expenses increased only 8% year-over-year and decreased 17% quarter-on-quarter.

Want your portfolio to outperform the market? 7investing’s lead advisor reveals the top seven opportunities in the stock market each month for members. Click here to try 7 investments for $1.

In terms of optimizing its cost structure, Upstart has eliminated 140 positions (7% of its workforce) from its lending operations. No further headcount reductions are planned and hiring is limited to a small number of strategic positions.

In terms of products and partnerships, the company has made some solid progress.

- In Q3, 75% of loans were fully automated. That’s a new record.

- 17 new banks/credit unions have been added to the platform. This is also a quarterly record. The total number of banks/credit unions on the Upstart platform has increased to 83.

- Billing model accuracy has improved significantly over the past four months.

- Small Business Loans Increased from $1M to $10M (New in R&D).

- Smaller Loans increased 4x last quarter (new products in R&D).

- Auto-lending is available in 3 dealer groups in 4 states.

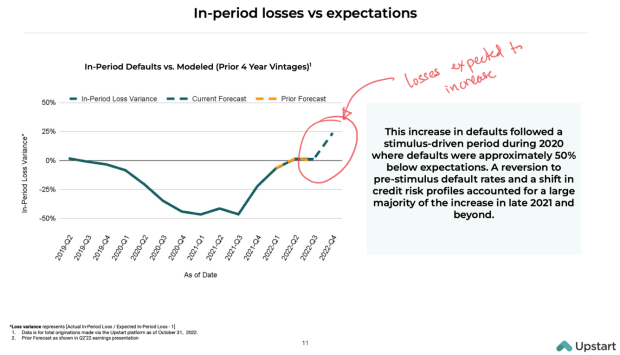

The company’s Q4 guidance was again poor. Fee income has declined further, and he is now expected to be at $160 million, with headwinds expected from fair value adjustments and interest expense. Upstart expects “Losses over time” vs. “Expectations” to increase to around 25%. Note that there is an upper limit on the loss to forecast. This is because older vintage loans don’t perform well, while more recent ones (high APR, low approval rate) are likely to perform well. For investors in Upstart’s funding network, long-term average returns matter.

So what are the results here?

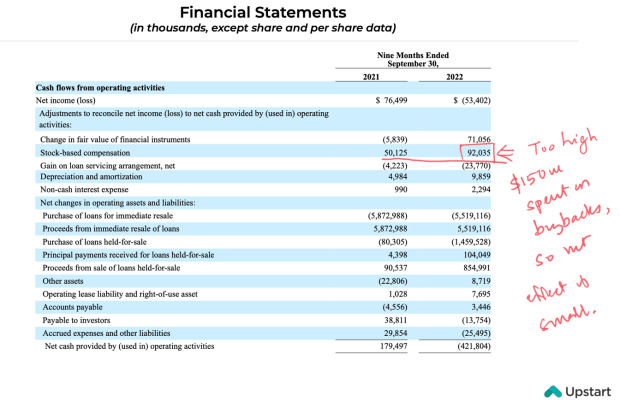

First, I’m assuming you’re looking directly at Upstart’s capital light model. Contribution margin increased significantly. His operating loss for the first nine months of fiscal 2022 was $55 million. Looking at this figure, and considering the other cost savings introduced, we can see that his $800 million cash balance at the company is buying enough time. There should be no immediate need for capital injection.

Second, models have adjusted through this recession and businesses have made great strides in automation and new products. When the tide turns, Upstart sets a firm footing and turns on the spigot.

Third, the market opportunity is still huge and I think the stock market is grossly undervaluing this company. potential value could be much higher than its $1.5 billion market cap.

Of course, that doesn’t mean the market will realize its mistake any time soon, or that stocks won’t fall any further. And there’s nothing stopping the rich from bringing in low-priced takeover offers. Fundamentally, being underestimated doesn’t necessarily mean the end result will be good.

Finally, I didn’t want to end the update with caution, but it would be my remiss not to mention stock-based compensation (SBC) dilution. In his nine months, Upstart spent $150 million to buy back its stock. In the same time frame, they issued his SBC for his $90 million. The company’s current assessment requires a significant reduction in SBC. Also, if I were their CFO, I would wait for the “upstart macro index” to start showing a path to normalization before buying back stock.

About the author: Anirban Mahanti 7 investmentPrior to 7investing, he spent more than five years at The Motley Fool’s Australian subsidiary in various positions. Among them were his Director of Research and Founding Chief Advisor of his newsletter Extreme Opportunities, a market-beating small-cap ASX stock picker. To follow Anirban on Twitter, click this link.

https://www.thestreet.com/investing/upstart-bright-spots-in-a-bad-report Upstart: A bright spot in a bad report